Every day I am told by one owner or another that they don’t need to pay tax on their Spanish property as they pay tax in their home country.

I’m afraid this just isn’t true and now with the advent of Rental Licenses and Sharing of information between countries etc, it is vital, and cheaper to know what you are liable for.

In Spain all owners, Resident and non Resident are liable for.

IBI

This is a local tax or ‘Council tax’ and is payable to your local AYUNTAMIENTO or Town hall. The tax is based on the Catastral Value of your property and for more information on what your IBI is … call into your local town hall before 2pm any weekday and they will happily tell you.

Payments differ in different areas but in general there is an incentive for paying on time and a direct debit is a great solution.

You will find your catastral number on the IBI bill, but if unsure, or you have not received an IBI bill, just bring a copy of your Passport/ NIE and the nota simple ( short copy of the deeds) to the town hall and they will advise you.

Unpaid IBI mounts up and incurs interest. Not the ideal thing to find out after years of not paying.

In the event of selling your property, all IBI must be cleared at that time. If it has been ignored it could be quite an sizable amount.

For help or advice regarding Catastral or IBI contact LCPSpain.com

RENTAL or INCOME TAX

Many owners rent out their property to supplement the running costs. Legalcostarentals.jpg If you rent your property you are legally obliged to file a Tax Return every quarter, specifically on the 20th of January, April, July and October.

Tax is payable on income from the property but you can also claim on certain expenses such as electricity, water, maintenance costs on a pro rata rate of rental occupancy. That is, if you rent for 33 weeks of the year, you can claim expenses on those 33 weeks, the remaining time is presumed that you had the property for no income and at your own disposal.

If you have registered your rental property for Holiday lets take extra care. Once registered it will follow that a quarterly tax return will be required. After all if you have a licence to rent, why aren’t you filing a return on the income?

Owners who don’t rent, but just keep the property as a holiday home are also liable to pay tax or IMPUTED TAX on the property.

This is again calculated on Catastral value and the property is considered a second, or holiday home. It is due every year on December 31st and a gentle warning. If the tax is not paid you run the risk of embargoes on your bank accounts. This can risk your bank accounts being frozen and essential utility bills may not be paid. Before this happens, you would be notified by post, so make sure you have a reputable company checking your post while you are away.

International Agreements

Depending on your home country of residence, there may be an agreement between them and Spain as to where what tax is payable. It’s a good idea to chat with a tax expert and make sure you don’t have some nasty surprises waiting around the corner. In most cases, the costs involved in operating correctly in the Tax world, are far less than the fines and difficulties embargoes can bring.

So, to recap, if you own a property in Spain, no matter where you live, there are annual or quarterly taxes payable in Spain.

For more information you can email your question to [email protected]

Here to help with everything you need for your property in Spain

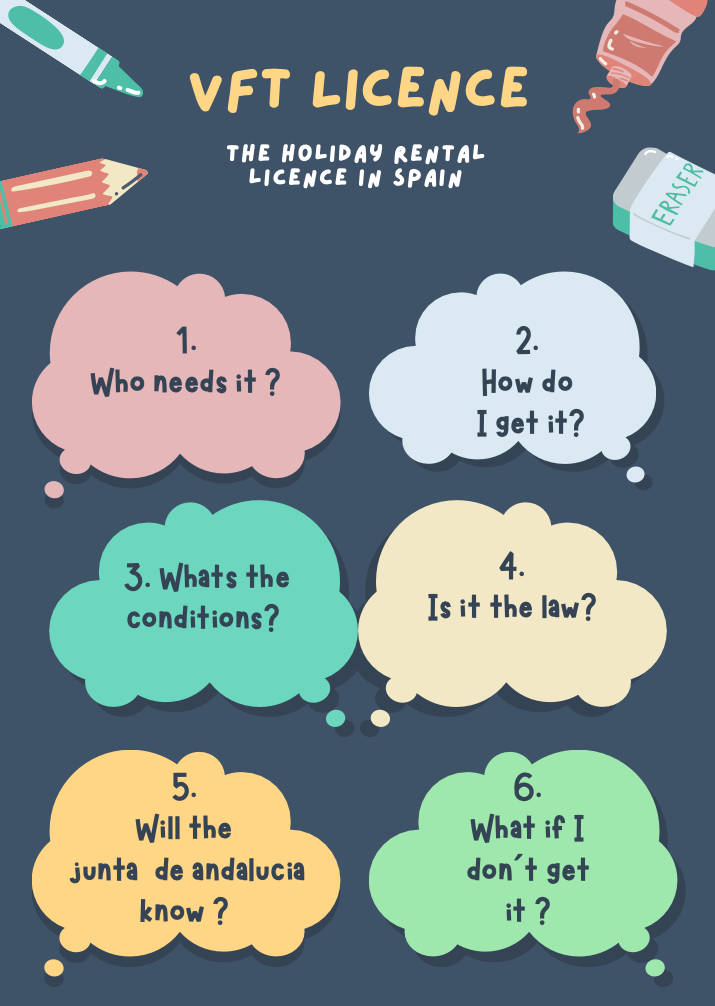

Andalucia Holiday Rental Law

The law in Andalucia has Changed since May 11th 2016. From this date properties rented for periods of less than 2 months Must register with