The Spanish Tax Man is writing to Non-Resident Property Owners… and it’s not a Valentine!

The Spanish Hacienda ( Tax Office ) has been keeping postmen & women all over the world very busy in the last few weeks.

In recent times, laws have been passed that compel Holiday rental sites such as BOOKING.COM, HOMEAWAY and AIRBNB, among others, to send details of all payments made to owners of Spanish Holiday Rental properties….No matter where in the world the owner lives.

Letters have been arriving in letterboxes as far afield as Australia to non-resident owners.

In a nutshell, if you own a property in Spain and are non-resident ( you live somewhere else) you should be making a NON RESIDENT TAX RETURN every year, once a year. Now before you start shouting at me …. Resident owners must do the same, but claiming that you are away or didn’t know about it, will get you nowhere.

If you are renting out your property to holidaymakers, you should ALSO be making a quarterly tax declaration of income and expenditures on the property. If you don’t tell the taxman, your booking agent/portal is obliged to do it for you, so one way or another Mr Taxman will know you are earning and will want his share.

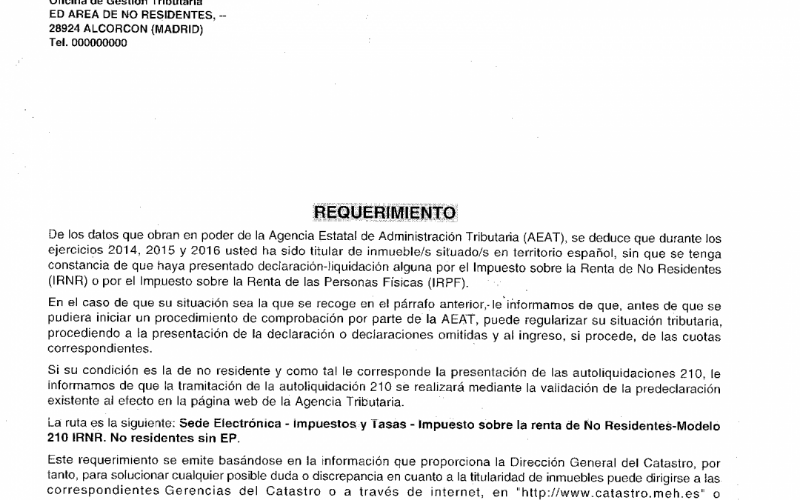

Due to the new ‘Rental Property Registration’ Hacienda is now receiving details of lots of owners who have not made a tax return as a non-resident or otherwise and are writing to each and everyone asking for their last FOUR YEARS tax return. If you have been paying, nothing to worry about. If not you could face your Spanish bank account being embargoed. If you have received such a letter it’s 99% certain you have not paid, as the Hacienda system will have not sent yo the letter if you have been a good citizen and paid your dues.

It’s a tax that will not go away so if you decide to sell your property you will be stopped in your tracks if the non-resident tax is not up to date,

Modelo 179 is the document that many owners are failing to complete, or have their tax consultant do for them.

While I’m at it,,,, let’s kill these old rumours once and for all.

‘I pay all my taxes in my home country so I don’t need to pay any in Spain.’ WRONG.

If the property is in Spain, the tax must be paid in Spain.

‘My clients pay me in my home country so I don’t need to pay tax in Spain.’ WRONG

If the property is in Spain, the tax must be paid in Spain.

For Non-residents who DON’T rent out their property, they have until December THE FOLLOWING YEAR to present their Non-Resident Tax Return.

Non-resident owners who DO rent are obliged to file a tax return ONLY for the quarters they rent. Quarters, where no rentals take place, are covered by the annual return.

Some Tips: When you buy something for your property ask the shop for A FACTURA and have them add the property owners Name and NIE number. Legitimate expenses can be claimed against the income.

Forget buying that kettle at home and bringing it in your luggage!

Only items purchased in Spain will count.

Electricity, water and community can also be % claimed, pro rata to rental days, so print your bill and send to whoever does your tax in Spain.

EU owners are taxed at 19% and Non-EU are taxed at 24%. Something else that Brexit didn’t tell you about….

Quarters are. Jan / Mar — April / June —- July / Sept and Oct / Dec, with returns due by the 20th of the following month, so, Jan / March is due on April 20th

So…… What now? If you are to leave this article with anything is is the old saying that the only thing we are certain of is Tax and death, but only one can’t be reversed.

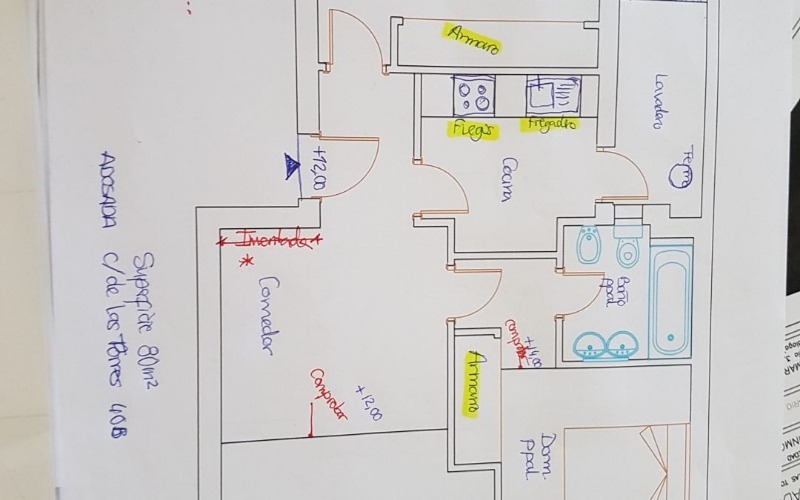

As you sit there reading and wondering what to do, maybe send an Email to [email protected] and include your NIE, Name, Property address and Catastral number. Also, a scan of the letter from Hacienda if it’s already arrived. The team there will get you up to date and back on track.

For Information regarding any aspect of owning a property in Spain just send an email to [email protected]

Legal Costa Property

Or come along to A PLACE IN THE SUN in London from May 10th to 12th for personal information.